Get This Report on Custom Private Equity Asset Managers

Excitement About Custom Private Equity Asset Managers

(PE): spending in business that are not publicly traded. Approximately $11 (https://www.edocr.com/v/vld3w5ze/madgestiger79601/custom-private-equity-asset-managers). There might be a couple of things you don't comprehend regarding the market.

Exclusive equity firms have an array of financial investment choices.

Because the finest gravitate toward the larger bargains, the middle market is a substantially underserved market. There are much more vendors than there are very experienced and well-positioned money professionals with comprehensive customer networks and resources to take care of a deal. The returns of exclusive equity are generally seen after a few years.

5 Simple Techniques For Custom Private Equity Asset Managers

Flying listed below the radar of huge international corporations, much of these small firms frequently supply higher-quality customer support and/or niche product or services that are not being used by the large empires (https://www.anyflip.com/homepage/hubrh#About). Such advantages bring in the passion of private equity companies, as they have the insights and savvy to manipulate such chances and take the firm to the following degree

Exclusive equity capitalists need to have reputable, capable, and dependable monitoring in position. The majority of supervisors at profile business are given equity and benefit settlement frameworks that reward them for hitting their monetary targets. Such placement of goals is generally called for before a deal obtains done. Private equity chances are usually unreachable for people that can not invest numerous dollars, yet they should not be.

There are policies, such as restrictions on the accumulation quantity of money and on the number of look at this website non-accredited investors. The private equity service brings in a few of the most effective and brightest in corporate America, consisting of leading entertainers from Lot of money 500 firms and elite monitoring consulting companies. Law practice can likewise be hiring premises for exclusive equity employs, as audit and lawful skills are required to total offers, and transactions are extremely searched for. https://worldcosplay.net/member/1673310.

The smart Trick of Custom Private Equity Asset Managers That Nobody is Talking About

Another downside is the lack of liquidity; when in a personal equity purchase, it is hard to get out of or market. There is an absence of versatility. Private equity likewise includes high costs. With funds under administration already in the trillions, personal equity companies have actually become appealing investment cars for well-off individuals and establishments.

Currently that access to private equity is opening up to even more individual capitalists, the untapped possibility is ending up being a reality. We'll begin with the primary disagreements for spending in exclusive equity: How and why private equity returns have historically been higher than various other possessions on a number of degrees, How consisting of exclusive equity in a profile affects the risk-return profile, by aiding to branch out against market and cyclical threat, Then, we will lay out some crucial factors to consider and risks for exclusive equity investors.

When it comes to presenting a brand-new property right into a portfolio, the many standard factor to consider is the risk-return account of that possession. Historically, personal equity has actually shown returns comparable to that of Arising Market Equities and greater than all other typical asset courses. Its reasonably low volatility combined with its high returns makes for a compelling risk-return account.

The Definitive Guide for Custom Private Equity Asset Managers

Exclusive equity fund quartiles have the best array of returns throughout all alternate asset classes - as you can see below. Approach: Interior rate of return (IRR) spreads determined for funds within classic years individually and after that averaged out. Typical IRR was computed bytaking the standard of the mean IRR for funds within each vintage year.

The takeaway is that fund choice is important. At Moonfare, we perform a stringent selection and due persistance procedure for all funds noted on the system. The result of including exclusive equity right into a profile is - as constantly - dependent on the portfolio itself. Nevertheless, a Pantheon research from 2015 recommended that including private equity in a portfolio of pure public equity can open 3.

On the various other hand, the most effective private equity firms have accessibility to an also larger swimming pool of unknown chances that do not encounter the same analysis, as well as the resources to carry out due persistance on them and identify which are worth buying (Syndicated Private Equity Opportunities). Spending at the ground flooring indicates greater risk, but for the business that do be successful, the fund benefits from greater returns

The Main Principles Of Custom Private Equity Asset Managers

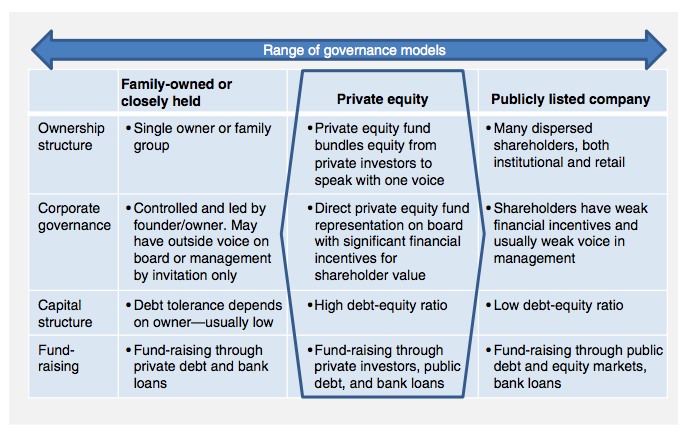

Both public and exclusive equity fund managers commit to investing a portion of the fund yet there continues to be a well-trodden issue with aligning rate of interests for public equity fund monitoring: the 'principal-agent issue'. When a capitalist (the 'principal') employs a public fund supervisor to take control of their funding (as an 'agent') they entrust control to the manager while preserving possession of the possessions.

In the case of private equity, the General Companion doesn't simply make a management charge. Personal equity funds likewise mitigate an additional form of principal-agent problem.

A public equity capitalist ultimately desires something - for the management to raise the supply cost and/or pay rewards. The financier has little to no control over the decision. We revealed above how numerous exclusive equity strategies - specifically bulk acquistions - take control of the operating of the business, making sure that the long-lasting value of the business precedes, rising the roi over the life of the fund.